We’re excited to introduce FOMO (FLock Open Model Offering), a new protocol layer that completes the demand side of the FLock ecosystem.

Over the past year, FLock has focused on building strong AI supply: training high-quality models, supporting serious researchers, and running decentralized infrastructure in production. With the launch of the FLock API Platform, developers can now easily create API keys, integrate models, and serve real-world inference. The remaining question was no longer about access, but about economics.

How should value flow when AI models are actually used?

FOMO is our answer to that question.

FLock Open Model Offering features

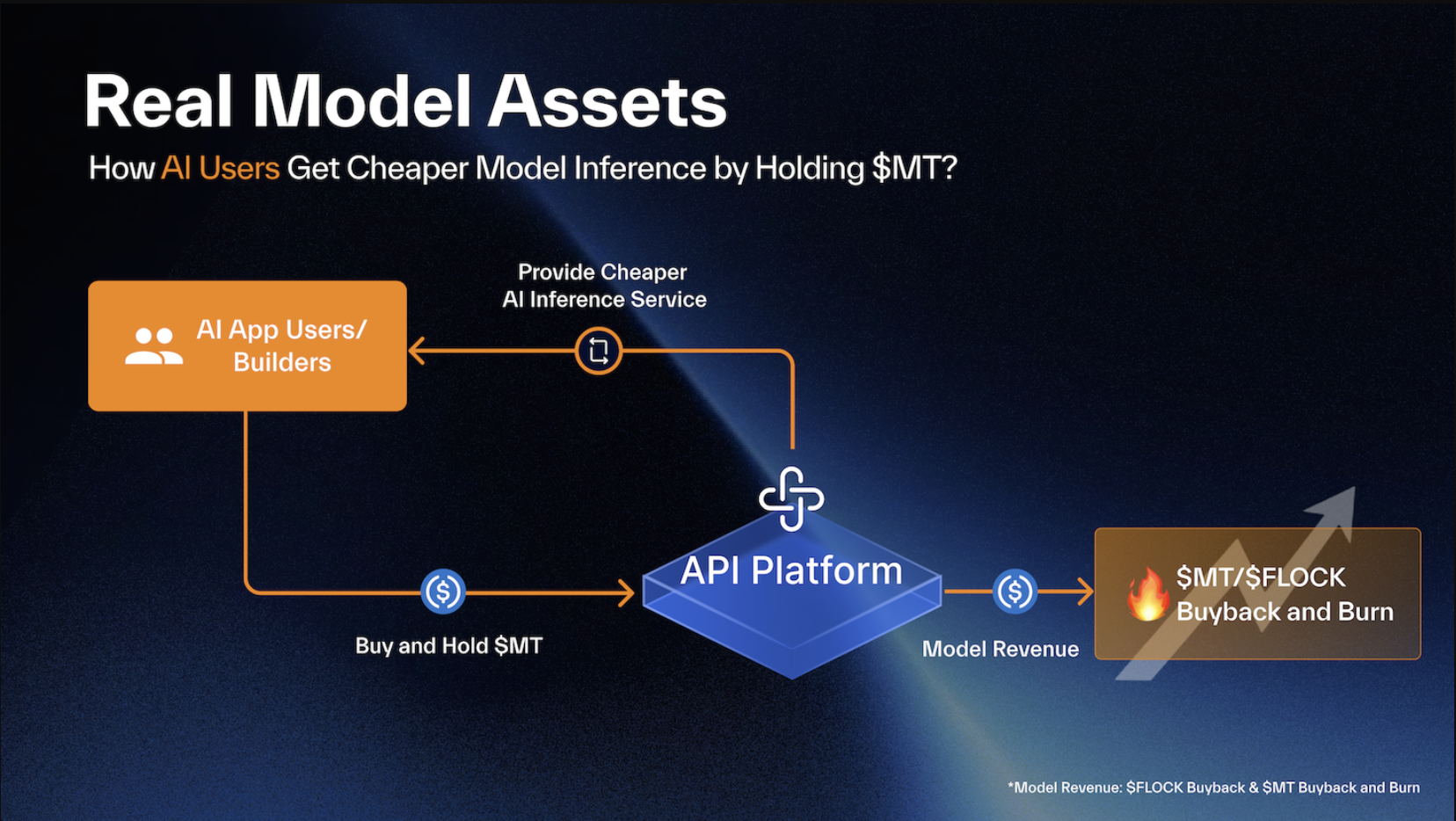

FOMO is a launch and incentive layer designed to turn concrete model deployments into Real Model Assets. It sits alongside the FLock API Platform and connects model deployment, inference usage, and economic incentives into a single, usage-driven system. Instead of treating inference as a stateless commodity purchased from centralized gateways, FOMO makes usage measurable, programmable, and economically meaningful.

In traditional AI infrastructure, pricing is rigid and upside is centralized. As usage grows, costs scale linearly, and the value created by developers and power users is largely captured by intermediaries. This model works for hyperscalers, but it breaks down for AI-native products, domain-specific models, and teams that rely heavily on inference as a core input.

FOMO flips this structure by enforcing a simple principle: value only flows when real usage happens. Models are launched through a Real Model Asset Offering, where users and RMAs supporters commit capital to fund a concrete deployment. Tokens are not minted upfront. Only if the launch meets its funding threshold does the model graduate, tokenize, and proceed to deployment. If it doesn’t, the launch simply doesn’t exist.

Once deployed on the FLock API Platform, the model begins serving real inference. From that point on, usage becomes the only signal that matters. Inference revenue is routed programmatically to buy back the model’s token, buy back the network token, fund ongoing operations, and reward the model operator. Early incentives help bootstrap adoption, but they decay over time as organic usage takes over. If a model isn’t used, rewards naturally disappear.

This design is intentional. FOMO is not a speculative launchpad, and it does not attempt to manufacture demand through emissions alone. Each model deployment becomes its own small, transparent economy, where incentives align around adoption rather than narrative. Power users are rewarded for driving real demand, operators are incentivized to maintain competitive pricing and quality, and the protocol remains sustainable without propping up idle capital.

FOMO also completes the loop with AI Arena, FLock’s decentralized training platform. AI Arena incentivizes the production of intelligence, while FOMO incentivizes its dissemination and use. Together with the API Platform, they form a full-cycle DeAI system where training, deployment, and consumption reinforce one another.

This is just the beginning. As more models are launched through FOMO and more inference flows through the API Platform, we’ll continue refining the mechanisms that turn real usage into aligned economic outcomes.

If you’re building with AI, operating models, or scaling inference-heavy applications, FOMO is built for you. Stay tuned as it rolls out across the FLock ecosystem.

Step-by-step guide

This guide walks through the FOMO launch lifecycle from both sides:

- Real Model Asset (RMA) Issuers launching a model

- Users and RMAs Supporters participating in a model’s fundraising

For RMA Issuers

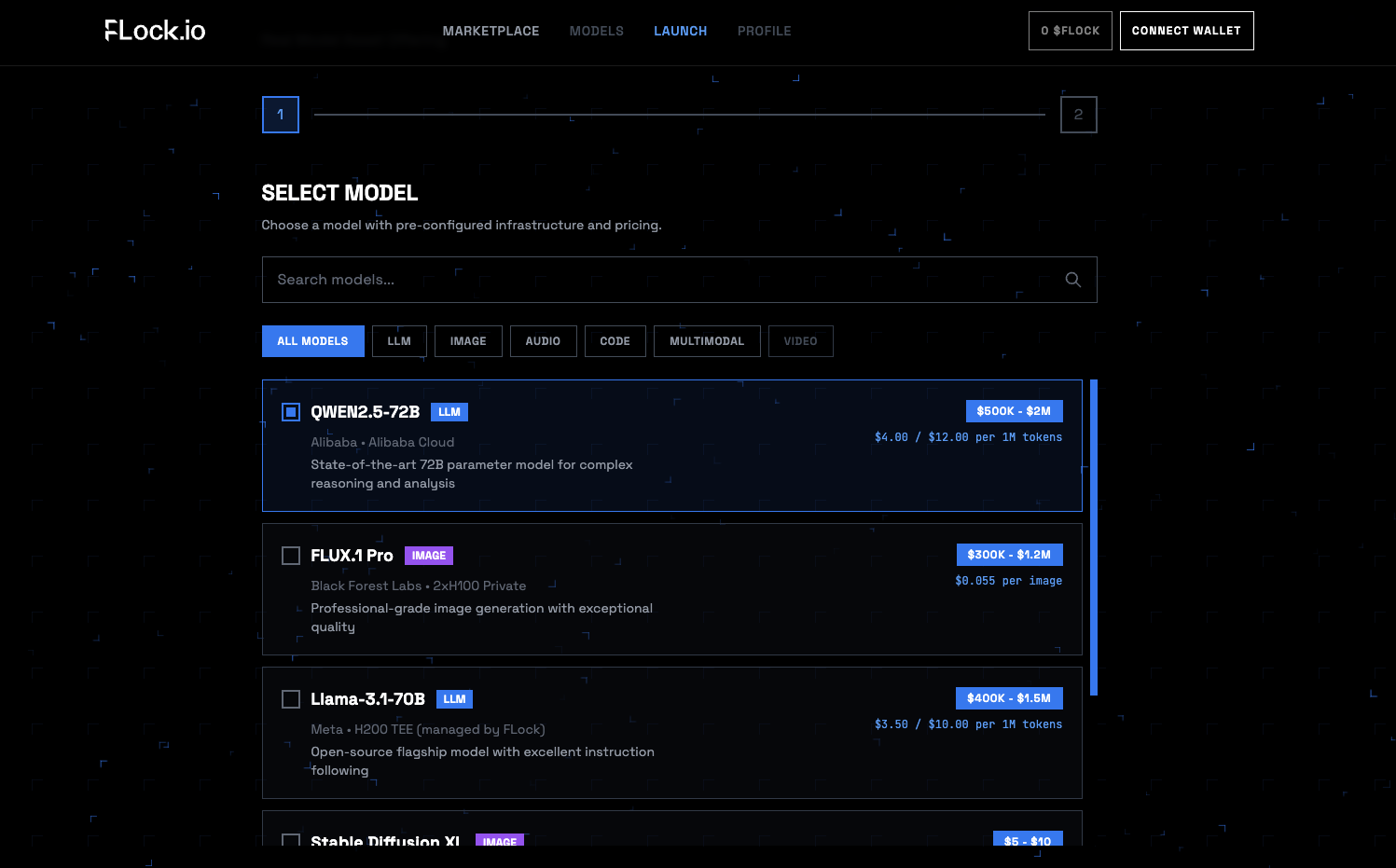

Step 1: Select a Model

- Go to the Launch page.

- Select your desired model.

Each model corresponds to a predefined inference pricing tier and an allowed fundraising range. These parameters are fixed by the platform to ensure economic sustainability.

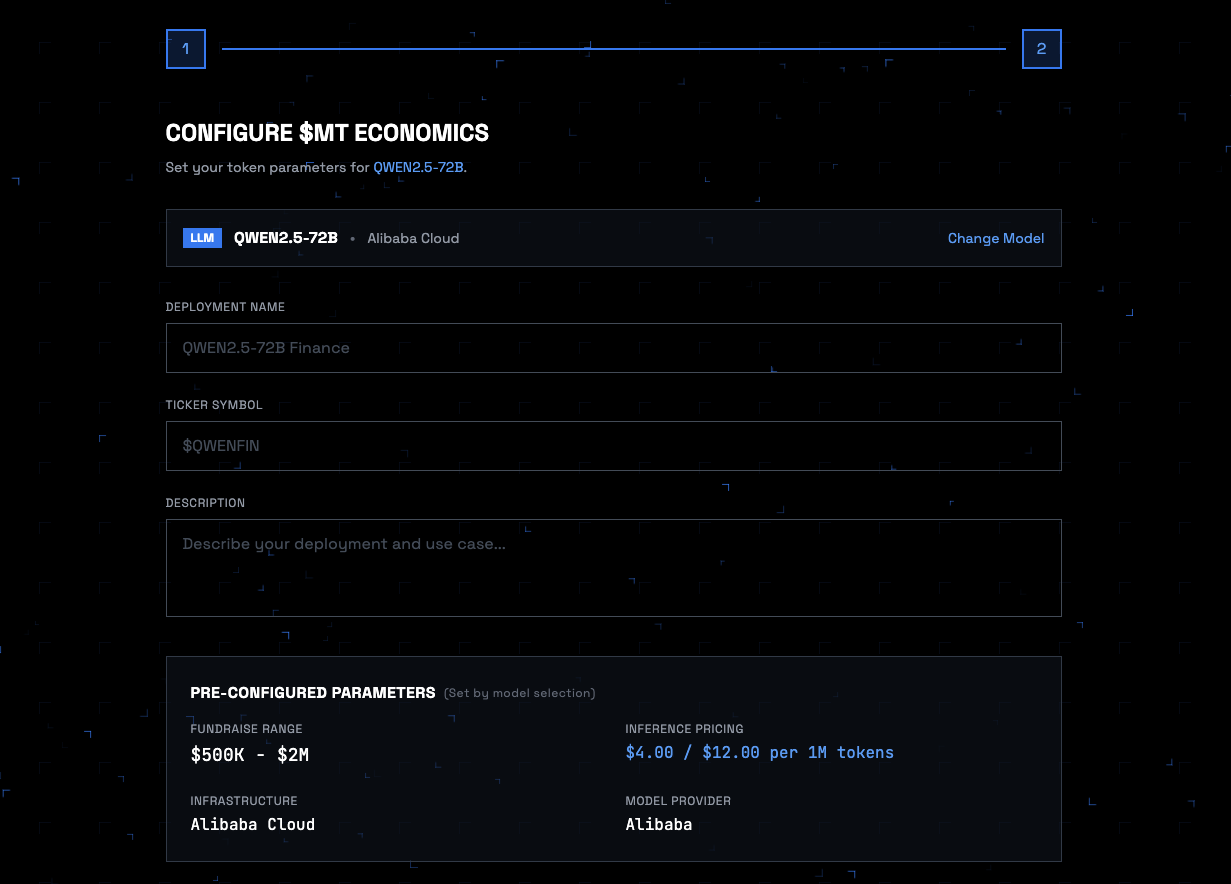

Step 2: Configure Your Model Token (MT)

Configure MT economics:

- Name your deployment and define:

- Model token name

- Ticker symbol

- Description

- Review the pre-configured parameters, including:

- Inference pricing tier

- Fundraise min / max range

- Token distribution summary

These values are automatically populated based on the selected model and cannot be arbitrarily changed.

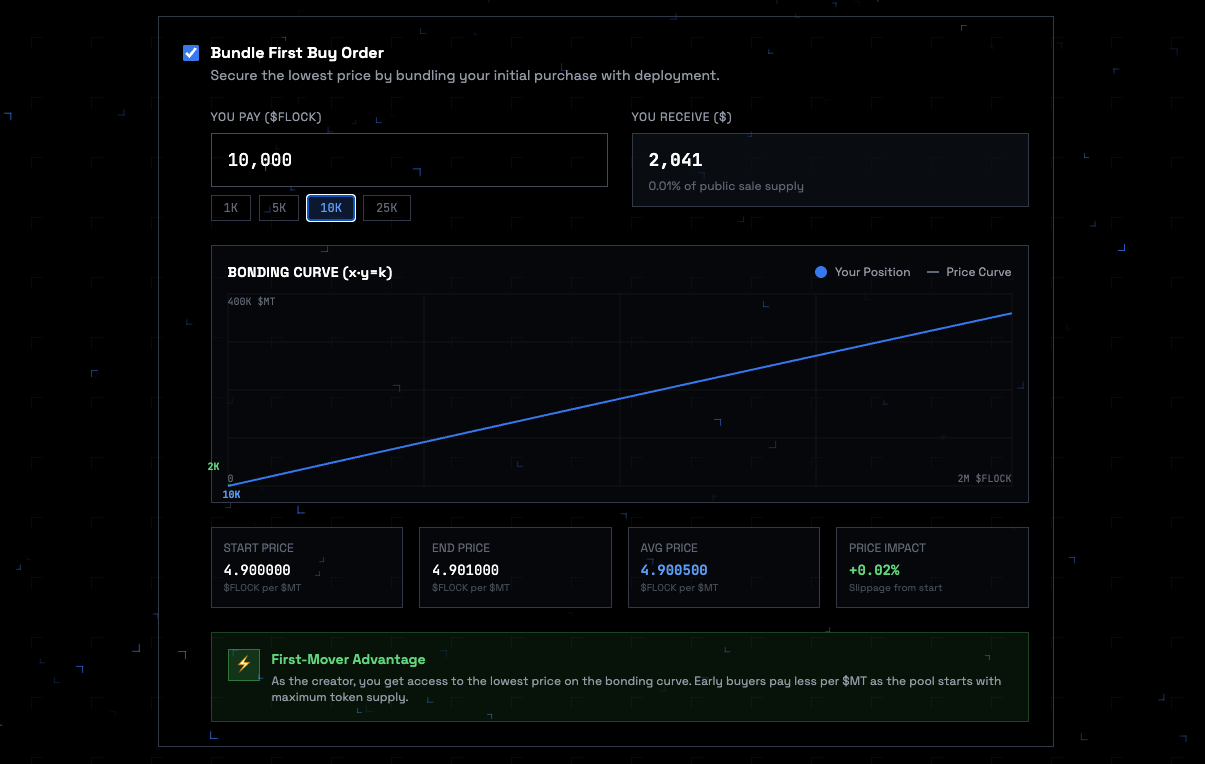

Step 3: Bundle the First Buy Order (Optional)

RMA issuers may choose to bundle an initial token purchase at launch.

- This provides a first-mover advantage by locking in the lowest point on the bonding curve

- The first buy is executed atomically with token deployment, removing market-timing risk

The bundled first buy is subject to a hard cap of 25% of the total MT supply to prevent excessive concentration at launch.

Note: The bonding curve applies throughout the entire fundraising period, dynamically pricing tokens as demand evolves — not just at launch.

Step 4: Confirm Launch Fee

Before initiating the Real Model Asset Offering (RMO), the RMA issuers must confirm and approve the launch-related fees.

This confirmation is required to proceed with model deployment and on-chain configuration.

- One-time launch fee. A fixed, non-recurring fee of $32768 FLOCK payable by the RMA issuers at the time of initiating the RMO. This fee covers deployment setup, onchain configuration, and protocol overhead associated with launching a new model economy.

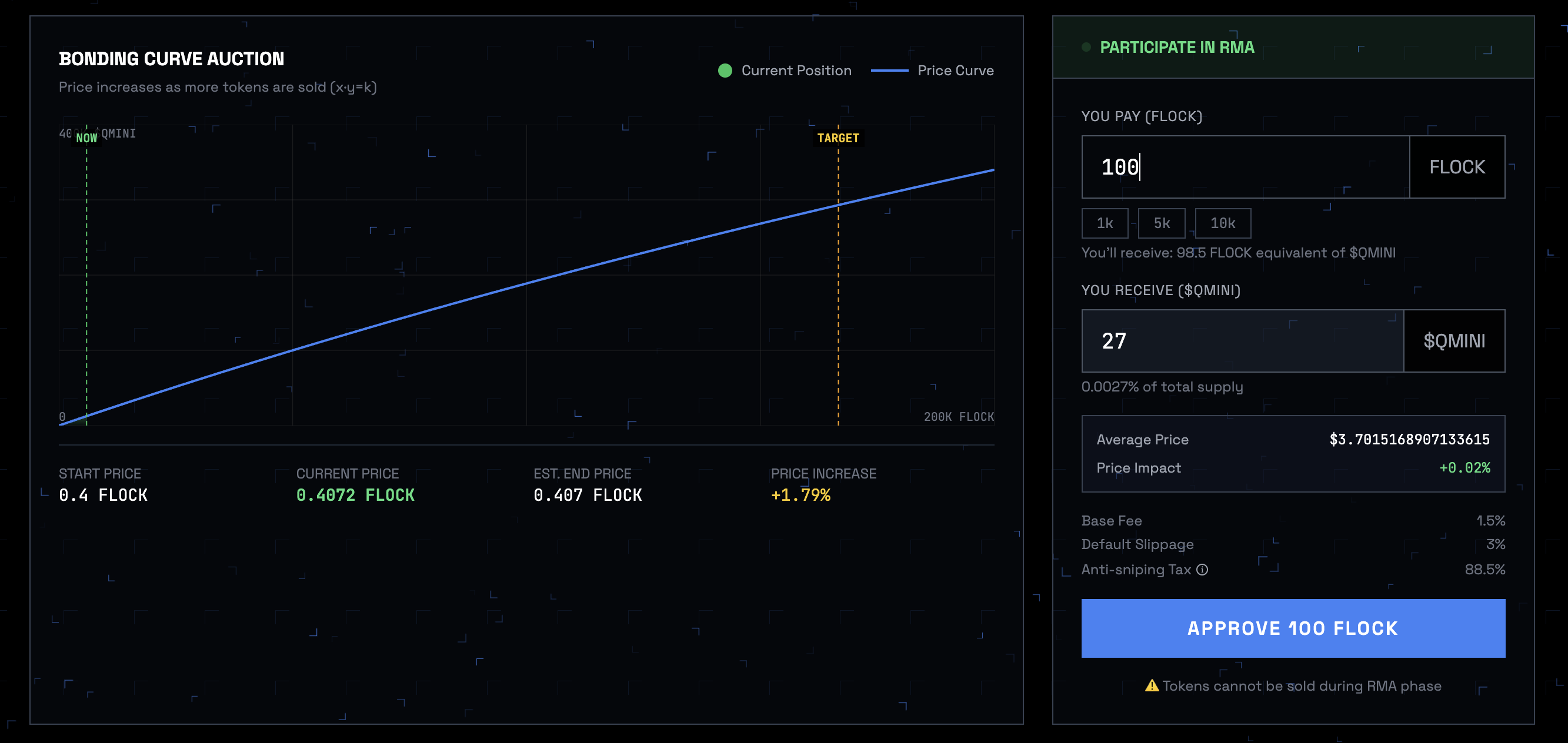

- Combined tax (base fee plus anti-sniping tax) starts at 99% and decreases by 1% per minute, until it reaches the base fee.

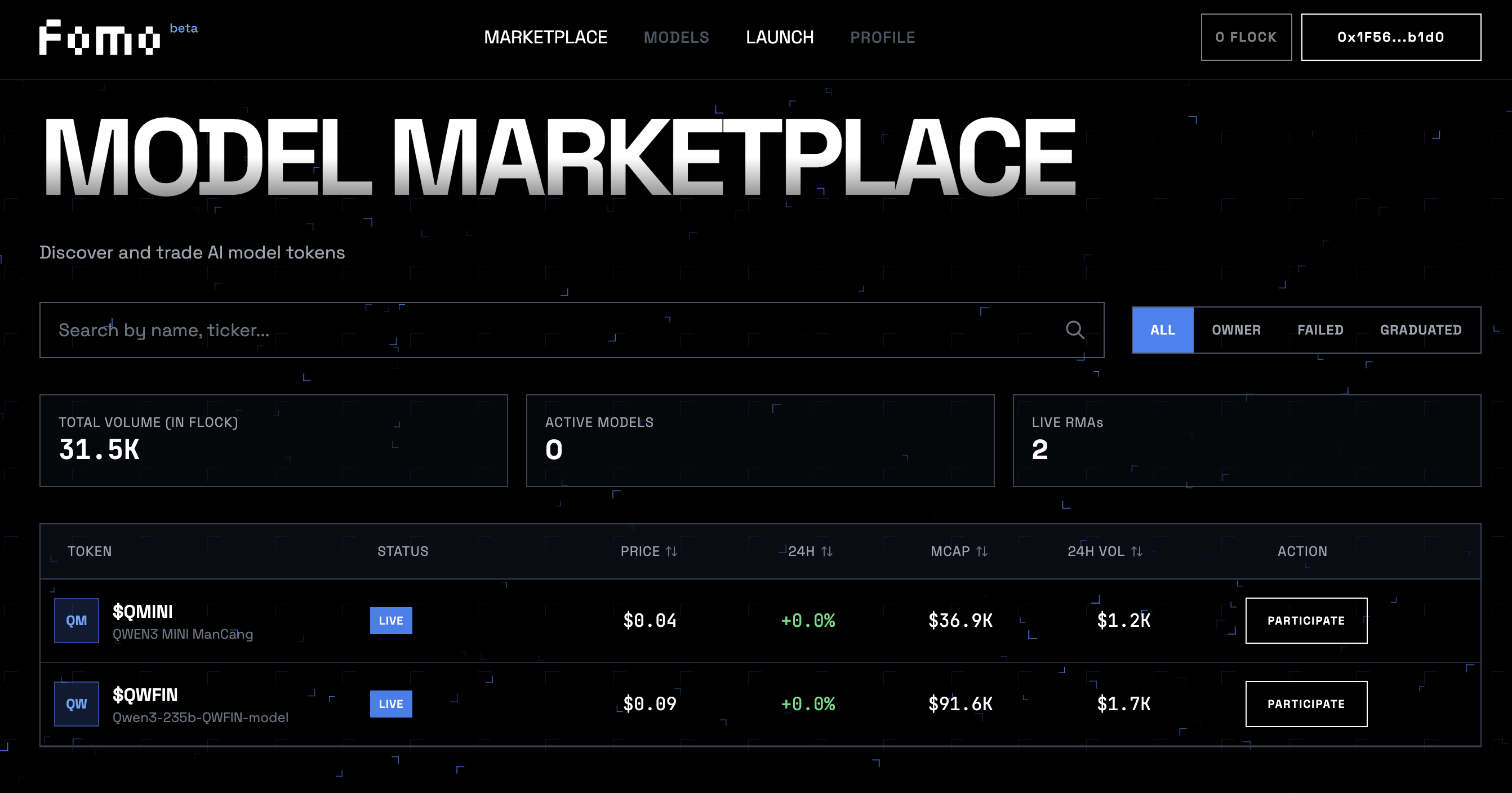

Step 5: Launch the Model Token

Once confirmed:

- The RMO is created

- The fundraising period 7 days begins

- Tokens are not minted during fundraising period

You can now find your deployment on the Marketplace page.

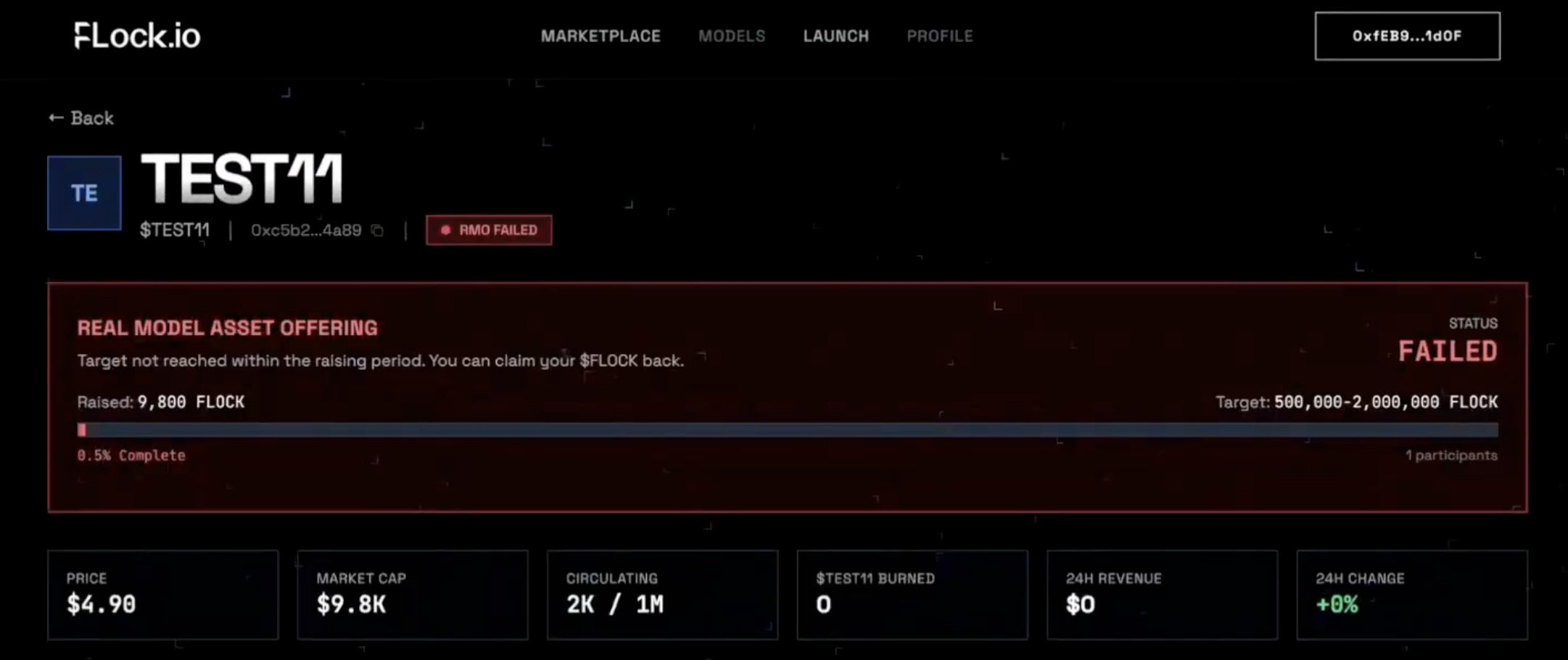

Status indicators:

- Owned — launched successfully by you

- Live — fundraising in progress

- Failed - fundraising target not met and pledged principal refunded

Step 6: Fundraising Period

- Fundraising remains open for 7 days

- Progress toward the minimum and maximum targets is tracked in real time (please refer to “Fundraise Outcomes” section for details)

- No action is required during this period

For Users and RMAs Supporters

Step 1: Discover a Model Token

- Navigate to the Marketplace page.

- Browse available model deployments and select a model token you want to support.

Step 2: Participate in the Fundraising

- Swap $FLOCK → MT via the bonding curve

- Token price increases as more $FLOCK flows in

- A 1.5% platform transaction fee applies to each swap

Note: MT purchased during fundraising cannot be sold back into the internal market during fundraising period.

Step 3: Wait for Fundraise Outcome

- The fundraising remains open for a fixed period.

- Progress toward the minimum and maximum funding targets is tracked in real time.

- No further action is required until the fundraising concludes.

Fundraise Outcomes

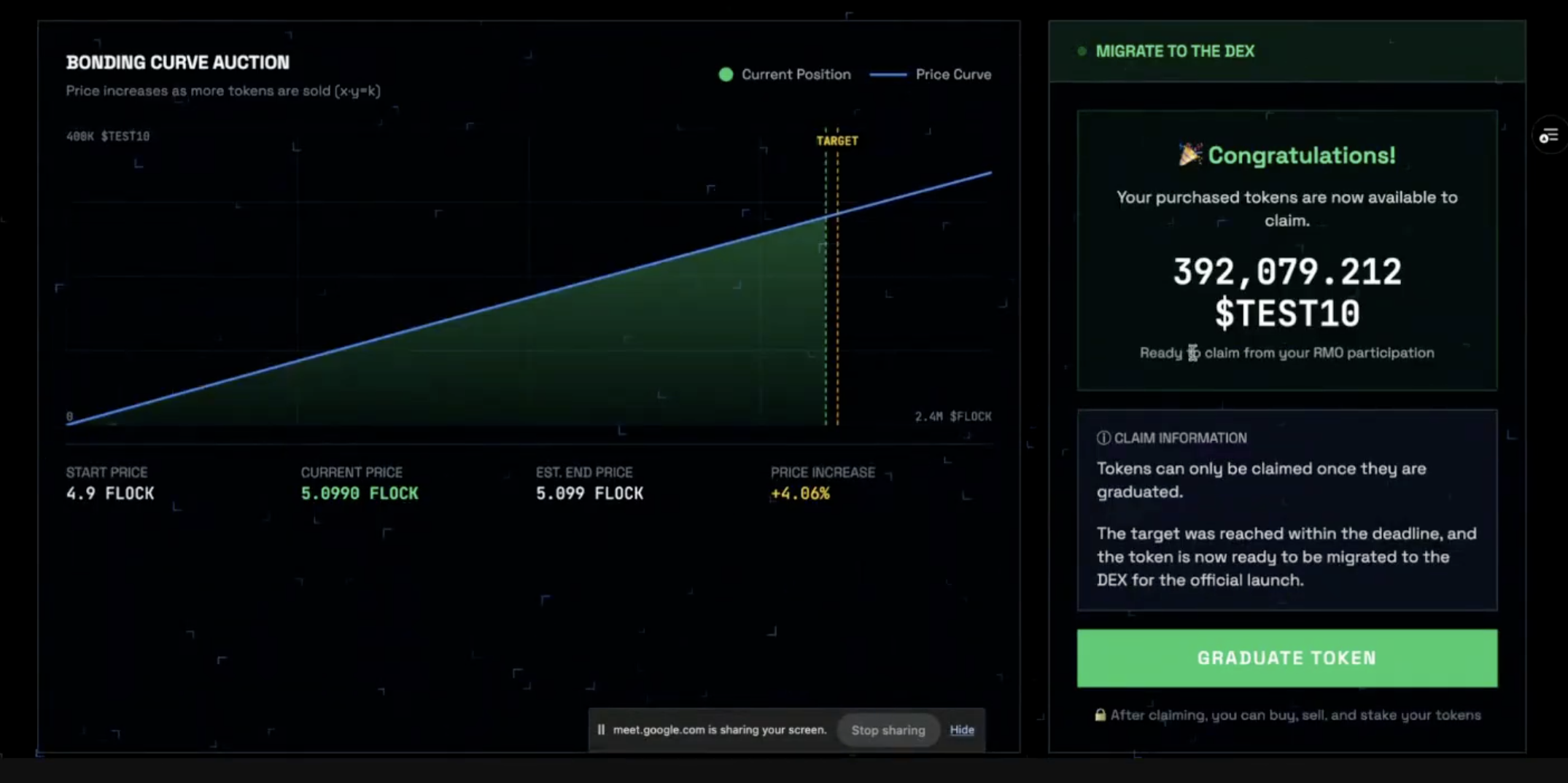

Scenario 1: Happy Path — Maximum Target Reached

- Graduation is triggered automatically

- Tokens are minted

- Liquidity is created

- The model proceeds to deployment

Scenario 2: Happy Path — Minimum Target Reached

- Graduation must be triggered manually

- Graduation is permissionless that anyone can trigger it

Action:

- Click “Graduate Token” to launch the liquidity pool

Scenario 3: Unhappy Path — Minimum Target Not Reached

- The fundraise fails

- Tokens are not minted

Action:

- Click “Redeem” to reclaim fundraised $FLOCK

- Launch fees and transaction fees are not refundable.

- Only the pledged $FLOCK principal is returned.

After Graduation

Once graduated:

- The model token becomes tradable

- Marketplace status updates to “Tradable on Deluthium”

- Clicking the token redirects users to the Deluthium swap page

- Note: Deluthium is currently not available in the US

From this point forward:

- The model will be deployed on the FLock API Platform

- Inference usage drives revenue, buybacks, and rewards