Simply put, no one will use a decentralised AI (DeAI) platform if the native token value is volatile. Users want stable inference prices; compute providers and model creators want reliable revenue. The problem is that token value fluctuates with market sentiment.

FLock.io has cracked the code to stabilise DeAI token economies. Currently, static buyback-and-burn mechanisms are the standard in such projects. But making it dynamic is shown to reduce token price volatility by an incredible 66% in our new academic paper.

Right now, a handful of tech giants control the AI marketplace. DeAI gives the power back to the people, democratising AI by letting anyone provide compute or build models. Through blockchain, DeAI platforms create a token economy where creators and providers get paid, and users get a fair price.

The problem is that the long-term viability of these ecosystems depends on economic stability, unlike traditional SaaS platforms with fixed pricing. Technical superiority alone cannot guarantee adoption if the economic layer is fragile. Why would a developer build on a decentralised network if their API costs could double by evening?

The economic layer must provide predictable revenue and stable inference prices – if it fails to do so then the project won’t get off the ground. Here’s how FLock.io put an AI economy that’s stable and predictable to the test.

[ 👋 Hi there! If you’re here to find out more about FLock.io, follow us on X, read our docs and sign up to AI Arena on train.flock.io. We just launched FOMO, completing our full-cycle DeAI platform.]

The paper is co-authored by Zehua Cheng, Wei Dai, Zhipeng Wang, Rui Sun, Elizabeth Lui, Nick Wen, and Jiahao Sun of FLock.io, University of Oxford, University of Manchester and Newcastle University. This blog is a brief, less technical introduction – read the full paper here.

Static tokenomics is the pitfall of most DeAI projects

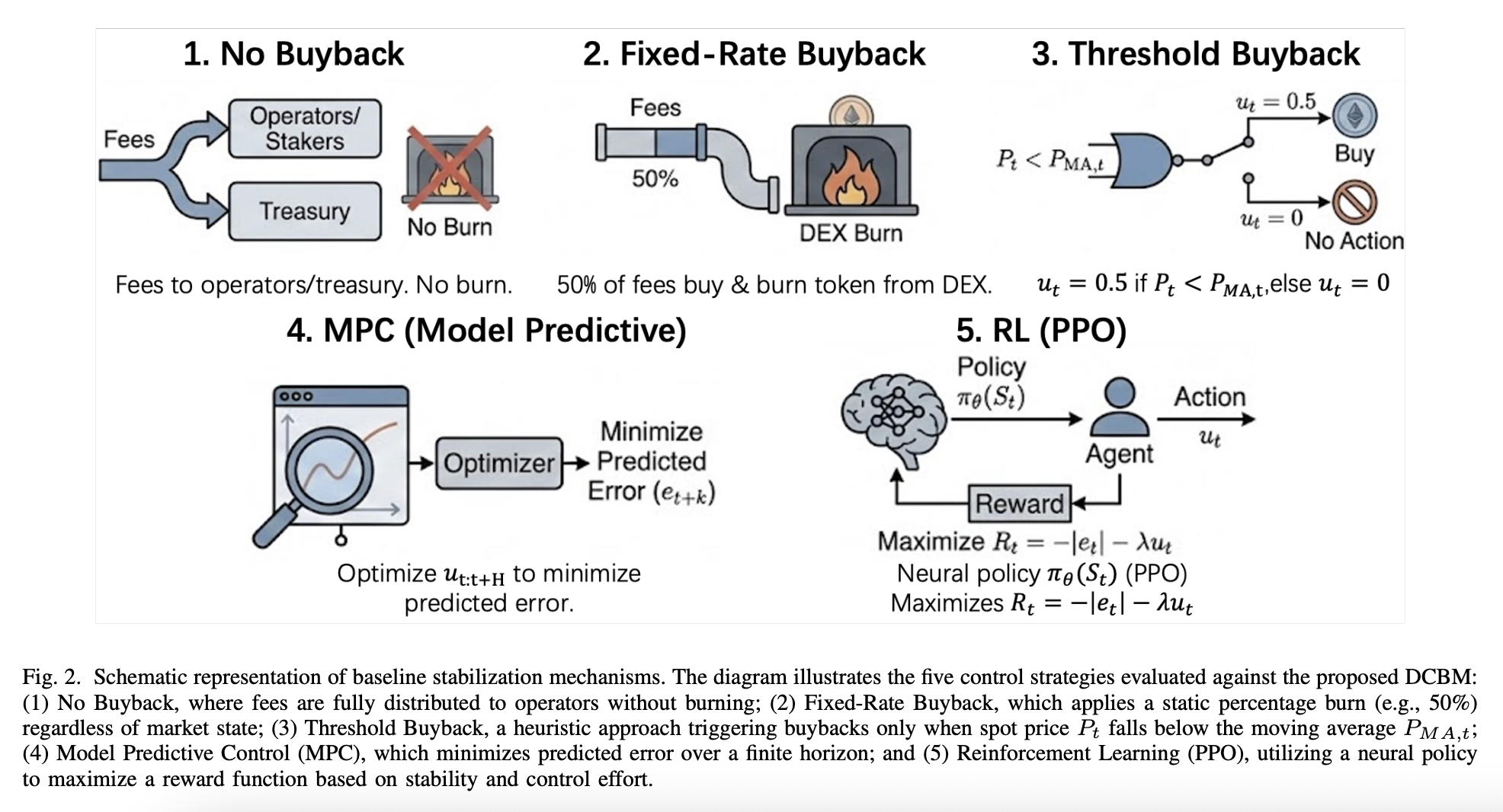

Despite this need for stability, current tokenomic models predominantly rely on static or simplistic heuristic mechanisms that are ill-equipped to handle complex system dynamics. The standard “buyback-and-burn” model operates independently of the network’s state, applying the same pressure regardless of whether the token is overheating or collapsing. That is, they might burn 20% of all fees, without altering the figure as the market rises and falls.

Even simple rules based on a certain threshold level (for example, buying as the price drops by X) demonstrate “bang bang” control features and therefore induce oscillations. The system will be brittle because it doesn’t adapt and doesn’t have continuous control; this will create feedback circuits between prices and activity in the network that can easily get out of control, because the parameters don’t adapt to exogenous shocks.

Tokenomics stabilised by making buyback-and-burn mechanisms dynamic

By instead modelling the token economy as a dynamic system, we can apply principles from control engineering to regulate it. That’s where the Dynamic-Control Buyback Mechanism (DCBM) comes in.

Just as a thermostat regulates temperature by adjusting heating output based on the deviation from a setpoint, our mechanism adjusts buyback pressure to minimise the deviation of token price from its long-term growth trend.

Across every scenario, this mechanism outperformed the alternatives. It stabilised the price and created a predictable environment, with a 66% reduction in volatility. It saw a significantly lower operator churn (down from 19.5% to 8.1% in high-volatility regimes). The system is also highly resilient against fishing attacks, where artificial volatility is introduced to trigger profitable buybacks.

Now that we’ve cracked how to foster the environment everyone wants, developers can focus on innovation, providers can scale and users can buy with confidence.

Our experiments

To prove the mechanism’s robustness, we conducted agent-based simulations, modelling the interaction between model owners, compute providers and users. Here are the ways we tested the system.

Market regime simulations

We used Jump-Diffusion processes to simulate various market conditions, which demonstrated that DCBM fundamentally outperforms static baselines. This accounts for “fat-tail” events – sudden price jumps or crashes that are well known in the crypto world

- Bull markets: Testing if the system can build up treasury reserves without over-spending when things are going well.

- Bear markets: Evaluating how effectively the “Integral” logic provides a price floor during sustained downturns.

- Black swan events: Simulating “90% crashes” to verify that our Asymptotic Solvency constraint keeps the network alive.

Adversarial attack testing

A decentralised, permissionless blockchain environment must be robust against attacks. We subjected DCBM to several game-theortic attacks:

- Fishing" attacks: Where a manipulator artificially crashes the price to trick the system into a subsidised buyback.

- Flash-loan exploits: Testing if the Derivative (D) term can distinguish between natural market movement and a one-second bot attack.

- MEV front-running: Ensuring that the protocol’s intervention doesn’t fall victim to arbitrage bots.

Comparative benchmarking

We ran the DCBM side-by-side against the industry standards:

Laissez-faire model: No buybacks at all.

Fixed-rate model: Burning a static percentage of revenue (the most common model today).

Threshold model: Only buying back when the price hits a specific hard floor.

Across every scenario, this mechanism outperformed the alternatives. It both stabilised the price and created a predictable environment.

Here were our evaluation metrics:

- Token Price Volatility: Standard deviation of log returns of the token price, and the average percentage deviation from the moving average

- Gini Coefficient of Token Holdings: To measure wealth concentration and decentralization within the network.

- Operator Churn Rate: Percentage of operators leaving the network per simulation period, normalized by total operators.

- Model Innovation Rate: Number of new high-quality models introduced per period, normalized by total deployed models.

- Network Treasury Health: The average rate of change of the treasury's value over time, and its stability (standard deviation).

- Control Effort: The average buyback rate $u_t$ and its variance, indicating the aggressiveness and stability of the controller.

FLock.io’s other research papers

FLock has released an array of papers since we began our mission in 2023. Last year, FLock reinforced its global standing at the forefront of DeAI innovation.

- “How to Fully Unleash the Productivity of Agentic AI: Decentralized Agentic Swarm Network” presented at the CFAgentic Workshop at ICML 2025.

- “On Weaponization-Resistant Large Language Models with Prospect Theoretic Alignment” paper.

- “Scaling Decentralized Learning with FLock” presented at the 1st Workshop on AI for Real-world Challenges (AI4RWC) co-located with the 24th International Conference on Web Intelligence and Intelligent Agent Technology (WI-IAT 2025). It also won a Best Application Award in WI-IAT 2025.

- “Multi-Continental Healthcare Modelling Using Blockchain-Enabled Federated Learning” paper won the Best Application Award at the IEEE Global Blockchain Conference

- “Defending Against Poisoning Attacks in Federated Learning With Blockchain” paper on the role of staking mechanisms in preventing malicious attacks in the journal IEEE Transactions on Artificial Intelligence. Most existing FL approaches rely on a centralised server, leading to a single point of failure. This makes the system vulnerable to malicious attacks when dealing with dishonest clients. We address this problem by proposing a peer-to-peer voting mechanism and a reward-and-slash mechanism, powered by on-chain smart contracts, to detect and deter malicious behaviors.

- “Prospect Theoretic Integrity Preserving Alignment” paper which we presented at the Royal Society. LLM training focuses heavily on maximising the likelihood of the “right” answer based on their training data (the “log-likelihood”). While this improves accuracy, it also amplifies biases present in the data and makes the models vulnerable to misuse. This paper proposes a solution grounded in prospect theory—a psychology concept that explains how people make decisions under uncertainty. Instead of solely focusing on optimising the model's accuracy, it takes a broader view, aiming to maximise the overall utility (usefulness and reliability) of the model. This makes LLMs more secure and robust against attempts to weaponise them.

- Systematisation of Knowledge (SoK) paper.

- In December, we rolled out a Systematisation of Knowledge (SoK) framework. This initiative aims to illuminate the road ahead for DeAI. The framework is a comprehensive guide for developers, researchers, and innovators, featuring a detailed review of over 40 DeAI projects.

- We published the paper ‘AI Arena: A Blockchain-Based Decentralized AI Training Platform.’ It explores our blockchain-based decentralised AI training platform designed to democratise AI development and alignment through on-chain incentive mechanisms.

- AI Arena fosters an open and collaborative environment where participants can contribute models and computing resources. Its on-chain consensus mechanism ensures fair rewards for participants based on their contributions.

- “How to Fully Unleash the Productivity of Agentic AI: Decentralized Agentic Swarm Network” presented at the CFAgentic Workshop at ICML 2025.

More about FLock.io

FLock.io is a decentralised AI training platform that enables the collaborative development of privacy-preserving models. The infrastructure integrates federated learning with blockchain-based verification to allow organizations and developers to train specialised AI without exposing sensitive raw data.

Find out more about FLock.io by following us on X, read our docs and sign up to AI Arena on train.flock.io. We just launched FOMO, completing our full-cycle DeAI platform.